Banxico has given up on its constitutional mandate?

If you enjoy our content, we invite you to support our work by subscribing to our premium news service. Your subscription will allow us to continue with our work and will also give you access to exclusive content. We appreciate your support in advance!

There are weeks that will be remembered for a long time for the precedents they set in economic and financial matters, and it seems to me that the week that has just ended will be one of them. As you all surely heard, last Thursday, August 8, the Board of Governors of the Bank of Mexico (Banxico) surprised most analysts by announcing that it decided to reduce the target for the one-day Interbank Interest Rate by 25 basis points to a level of 10.75%, effective as of August 9, 2024.

This decision was made by a majority of three votes in favor of the decrease and two votes for it to remain unchanged. Only Irene Espinosa and Jonathan Heath voted in favor of maintaining the target for the Interbank Interest Rate.

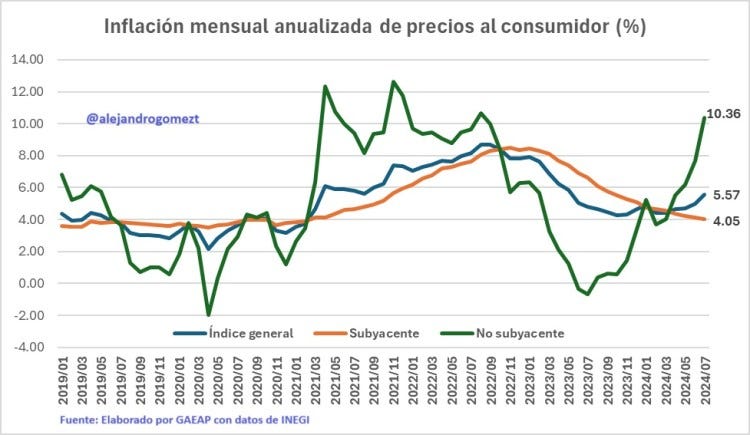

The surprise of the decision arose because very few thought that the central bank would dare to reduce its target interest rate in a context of rising inflation. Precisely on the same day that Banxico’s decision was announced, INEGI reported that overall consumer price inflation rose to 5.57% annually in July, as the core inflation stood at 4.05%, while the non-core inflation shot up to 10.36 percent.

In this way, general inflation accumulated five consecutive months of increase and now we have the highest inflation since May 2023. For its part, underlying inflation continued to fall and added 21 consecutive months of decreases at an annual rate. What is a disaster is non-core inflation (that of agricultural goods, energy and government-authorized tariffs) that accumulates 10 consecutive months of significant increases, since it went from just 0.56% annually in October 2023 to 10.36% annually last July.

The surprise at the Bank of Mexico’s decision also occurred because inflationary expectations for the remainder of the year have deteriorated significantly. The Banxico Private Sector Expectations Survey for the month of July mentions that respondents expect inflation to be 4.65% at the end of this year, while the most recent Citibanamex Expectations Survey published on August 6, places year-end inflation at 4.63%.

But what is worse, the Bank of Mexico itself has updated its inflationary expectations upwards and in the press release issued to announce its monetary policy decision of August 8, a table appears in which it mentions that it expects inflation for the fourth quarter of this year to be 4.4%. This contrasts with the 4.0% inflation expected when the last monetary policy decision was announced on August 8.

It should be remembered that the Bank of Mexico’s inflation target is 3.0% with a margin of error of +/- one percentage point, so the current inflationary level is far from the target. Given the above, it is worth asking the following: If Banxico’s only constitutional mandate is to preserve the purchasing power of the currency (it does not have a triple mandate that forces it to encourage economic growth and reduce unemployment, as modern central banks do), how did it make the decision to lower the interest rate in a context of rising inflation and deteriorating inflationary expectations?

In fact, Banxico identifies the upward risks to inflation and mentions them in its press release, which I transcribe below: i) persistence of core inflation; ii) greater exchange rate depreciation; iii) greater cost pressures; iv) climatic impacts; and v) escalation of geopolitical conflicts. The central bank also sees that there are elements that could influence lower inflation, such as: i) lower economic activity than anticipated; ii) less pass-through of some cost pressures; and iii) that the effect of exchange rate depreciation on inflation is lower than anticipated. However, Banxico warns in its press release that the balance of risks with respect to the expected path of inflation in the forecast horizon remains biased upwards.

As can be seen, it is very difficult to understand or explain the decision of the Bank of Mexico, although in the press release they mention the following: “The core (inflation), which best reflects the inflation trend, added eighteen consecutive months of reductions in July 2024. In this month it stood at 4.05%. Its impact on annual general inflation went from a maximum value for this inflationary episode of 6.32% in November 2022 to 3.07% in July 2024.” In other words, the only argument they use to justify their decision is that core inflation is going down.

This is undoubtedly a big mistake because eventually non-core inflation, which impacts the general index, ends up contaminating the core component as well. Let’s look at a simple example: general inflation is 5.57% and your company’s employment contract is due to be revised, then it is logical that workers will ask for a salary increase of at least that percentage. If they obtain this increase, this will have an impact on the company’s costs, which will end up increasing prices and thus transferring non-core inflation to the core component (that of goods and services). We should also not forget the initiative to amend the Mexican Constitution that the minimum wage should not increase less than inflation.

Something that also caught the attention is that prior to the meeting of the Board of Governors of Banxico, the expectation was that a drop in the interest rate would cause a depreciation of the peso. In reality, the opposite happened and the peso appreciated against the dollar, the dollar went from costing $19.24 pesos on Wednesday August 7th to $19.10 pesos on Thursday August 8th and closed the week at $18.84 pesos on Friday August 9th. And since there is no such thing as «what if,» so as not to contradict the logic of the market, there are two possible solutions to this mystery:

If Banxico had not lowered the interest rate, the peso would have appreciated more. It should be remembered that on Friday, August 2, the dollar closed at 19.051 pesos and on Sunday there was the yen-peso carry trade crisis, which led the parity to exceed 20 pesos per dollar on the night of Sunday, June 4 in the over-the-counter market.

Global investors expected or feared a further decrease in the interest rate and when they saw that it was only a quarter of a point, it was a positive signal to return some positions to Mexico.

Now, the most important question of all: who benefits from this decision by the Bank of Mexico?

Many argue that the drop in the interest rate will give a new boost to economic activity, encouraging investment. I highly doubt that this will be the case for two reasons: 1. The economy reacts to monetary policy decisions (increasing or lowering the interest rate) very slowly, with a lag of 6 months to a year; and 2. The drop is really marginal enough to be something that moves the needle in companies’ investment decisions.

Where a benefit can be seen is for those who have loans contracted at a variable rate, since there is an immediate drop in the 28-day TIIE of a quarter of a percentage point, so companies and people in this situation will benefit. But the biggest beneficiary of all is the biggest debtor of all, and I am referring to the federal public sector.

Well, it turns out that the public sector, as of June 2024, has an internal debt of 12.242 trillion pesos, of which 12.159 trillion were in the form of securities issuance. I set out to do some calculations and my estimates are that with the quarter-point reduction by Banxico in the interest rate, the public sector saves about 30 trillion pesos annually in interest payments. Not bad for a government that urgently needs to reduce the fiscal deficit from 5.9% of GDP in 2024 to 3.5% of GDP in 2025 without fiscal reform.

Another reduction in the target rate at the next meeting of the Governing Board on September 26, aligned with the expected reduction in the federal funds rate by the Federal Reserve Bank of the United States (FED), will generate savings of another 30 billion pesos. It is clear that Banxico is helping the Ministry of Finance (SHCP) in its fiscal objectives.

And with this point I want to close this installment. After Banxico’s decision was made public, rivers of digital ink have flowed in the sense of questioning whether the Mexican central bank maintains its commitment to the fight against inflation or if it has lost its autonomy and will now make its decisions based on the interests of the Ministry of Finance. That is why this decision is perceived as erroneous, unnecessary and risky since it questions the reputation and commitment of the central bank to fight inflation. Hopefully three decades of prestige of the Bank of Mexico will not be thrown away.