Misleading Signals

The persistence of core inflation and the ongoing withdrawal of foreign investment contrast sharply with a monetary easing strategy that appears to prioritize fiscal relief over financial stability.

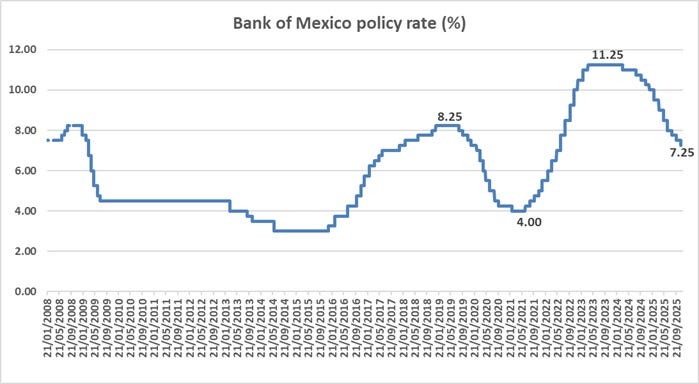

Mexico is at a moment in which the conduct of monetary policy carries decisive weight for financial stability and the country’s perceived risk. On November 6, the Bank of Mexico once again lowered its benchmark interest rate by a quarter of a percentage point, bringing it down to 7.25%, with the possibility of further cuts to 7.00% before year-end. The decision came in a context where economic activity contracted by 0.3% in the third quarter of 2025, the peso weakened slightly, and there has been a significant withdrawal of foreign investment from government securities. Added to this is a crucial factor: core inflation (goods and services) remains above 4% year-over-year and has failed to break below that level for eleven consecutive biweekly readings.

The key question, then, is whether monetary policy is responding appropriately to the balance between economic growth and inflation, or whether it is instead prioritizing a reduction in the government’s financing costs at a time of economic weakness and persistent inflationary pressures. The signals being sent at this moment may shape not only market behavior in the short run, but also the credibility trajectory of an institution whose constitutional mandate is to preserve price stability.

Capital Outflows and Rate Cuts in a Fragile Environment

As of October 28, foreign investors have withdrawn 134 billion pesos from Mexican government bonds—more than 7% of the total foreign holdings in those instruments. A capital outflow of this magnitude is not a minor fluctuation. When capital exits, demand for peso-denominated assets falls, weakening domestic financial conditions. In such a scenario, the typical policy response is to maintain relatively high interest rates to compensate for perceived risk and deter further outflows.

Yet the central bank chose to cut rates. The official justification is that economic activity has softened and that the Federal Reserve has also lowered rates, creating room for Mexico to adjust its stance. The bank also argues that headline inflation has been trending toward the 3% target, making the easing cycle consistent with its forecast horizon.

However, behind this technical rationale lies a direct fiscal implication. Lower interest rates reduce the government’s debt servicing burden. In a year with a large fiscal deficit, easing monetary policy provides immediate relief to public finances. This reality cannot be ignored. The problem arises when monetary policy begins to facilitate government financing rather than focusing on its core mandate. In that case, short-term fiscal sustainability is prioritized over price stability and the credibility of the central bank’s autonomy.

Investors understand this signal. They do not look only at the new policy rate. They look at what the decision reveals about priorities.

Persistent Core Inflation and Risks Recognized by the Central Bank Itself

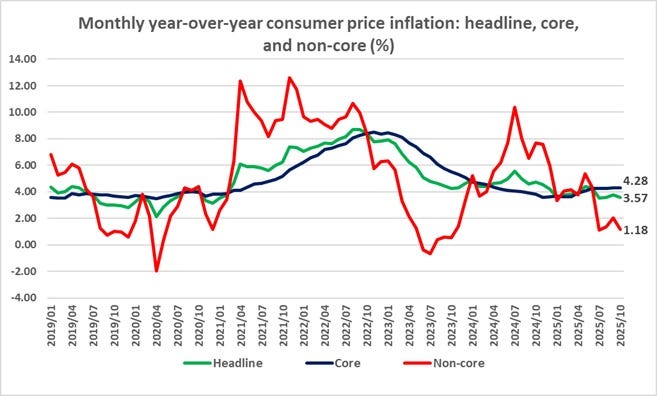

If one looked only at headline inflation, now at 3.57%, the disinflation process might seem advanced enough to justify rate cuts. But headline inflation is influenced by volatile components such as energy and agricultural prices. To assess underlying price dynamics, one must look at core inflation—and here the picture is different.

Core inflation stands at 4.28% and has remained above 4.0% for eleven consecutive biweekly periods. Its rigidity suggests that cost pressures in production chains, services, and logistics have not eased sufficiently. This persistence signals that the economy has not fully absorbed recent structural cost adjustments (such as steep increases in minimum wages and rising security-related expenses), and that indexation mechanisms remain active.

The Bank of Mexico itself acknowledges that inflation risks are tilted to the upside. These include potential peso depreciation, entrenched core inflation, spillovers from global trade conflicts, internal cost pressures, and climate-related effects on food production. These are not marginal or transitory factors—they directly threaten price stability.

Cutting rates when inflation risks outweigh disinflation risks weakens the policy anchor and de-anchors expectations. This concern is amplified by the fact that the decision was not unanimous. Deputy Governor Jonathan Heath voted to hold rates steady. His dissent signals a view that core inflation must firmly return to levels consistent with the permanent target before easing policy further.

This dissent should be read as a warning.

What Is at Stake: Financial Stability, Institutional Credibility, and External Perception

The combination of capital outflows, persistent core inflation, and monetary easing creates a vulnerability. The situation is not yet critical—but it is delicate. Financial stability depends heavily on the market’s perception of the coherence between policy actions and stated objectives.

If rates fall while capital leaves, the rate differential with the United States narrows, the peso weakens, and inflationary pressures may re-emerge. In such a scenario, the central bank could be forced to reverse its own easing cycle. This stop-go pattern—easing only to tighten again—would damage the institution’s credibility and undermine planning for businesses and households.

Credibility takes years to build, and it can erode quickly if markets perceive that the central bank’s primary mandate is subordinate to fiscal convenience. When the signal is that financial fragility is acceptable to lower the government’s interest burden, markets react immediately—long before any intended economic benefits materialize.

Conclusions

Mexico is at a point where monetary policy must operate with precision and clarity. Headline inflation is nearing target, but core inflation remains sticky—and consumers feel this directly. The economy weakened in the last quarter and faces external uncertainty. In this context, the simultaneous capital outflows and rate cuts require careful scrutiny.

Rate cuts may reduce the government’s debt burden in the short term, but they may also weaken financial stability if the central bank is perceived as easing prematurely. The challenge is to avoid decisions today that undermine the ability to control inflation tomorrow.

A credible central bank is one of a nation’s most valuable assets. The signal Mexico sends now will have effects far beyond this moment. In times like these, what is said matters as much as what is done.

Alejandro Gómez Tamez

Director General, GAEAP

Follow on X: https://x.com/alejandrogomezt